tax loss harvesting wash sale

Updated Sun Jan 30 2022. Heres what to know With tax-loss harvesting you only pay taxes on the net profit from your investments.

Tax Loss Harvesting Definition Example How It Works

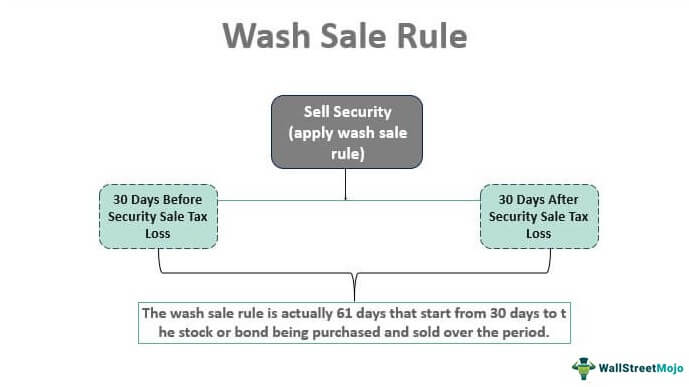

The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock.

. Fair Market Value is the market price of the cryptocurrency at the time you sold traded or disposed of it. Or if youre feeling generous you can also donate your assets to a tax-exemption organization. In our 1st example above 25000 is Christophers cost basis and 35000 is the fair market value at the time of the sale.

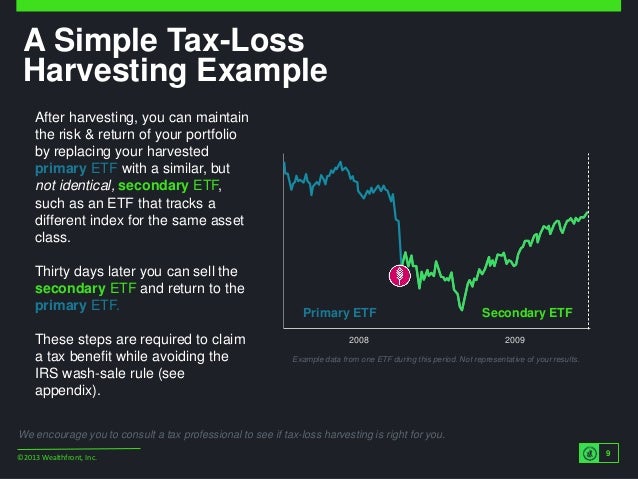

The Beginners Guide to Cryptocurrency Tax Loss Harvesting. The wash sale rule can make it difficult to harvest tax losses from a stock that you hope to rebound. Fair Market Value - Cost Basis GainLoss.

This is the principle behind tax-loss selling also known as tax-loss harvesting. The wash-sale rule states that your tax write-off will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical security within 30 days before or after the date you sold the loss-generating investment. Cost Basis refers to the amount it costs you to acquire the coin.

Tax Loss Harvesting. If your losses outweigh your gains you can offset 3000 of income as well as take advantage of the lack of wash sale rule using tax-loss harvesting. Aside from that you can also consider buying crypto via an IRA Individual Retirement Account.

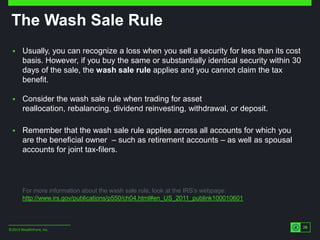

The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a. A wash sale is a purchase of identical or substantially identical replacement shares of an asset you sold at a loss during that 61-day 30 days before. The Wash Sale Rule May Be Coming to Crypto in 2022.

The rule prohibits you from claiming a tax loss if you repurchase the same security or a substantially similar security either 30 days before or 30 days after selling a security for a loss. Tax-loss harvesting can help lower your tax bill. By being out of the stock for roughly a month you might well miss out on.

What you want to avoid in the 30-day window before and after tax loss harvesting is a wash sale. This is known as a wash sale. The wash sale rule can be legally circumvented by buying back a different stock or security than the one that was.

Investors should educate themselves about the IRS wash sale rule described in IRS Publication 550.

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

/shutterstock_222298069-5bfc3d0dc9e77c00587b710b.jpg)

How To Avoid Violating Wash Sale Rules When Realizing Tax Losses

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Tax Loss Harvesting Wash Sales Td Ameritrade

Tax Loss Harvesting And Wash Sale Rules

A Simple Tax Loss Harvesting Example

Tax Loss Harvesting And Wash Sale Rules For 2021 And 2022 Increase Deductions And Tax Credits Youtube

Tax Loss Harvesting And Wash Sale Rules

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Year Round Tax Loss Harvesting Benefits Onebite

Wash Sale Rule Definition Example How It Works

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting And Wash Sales Seeking Alpha

Tax Loss Harvesting Wash Sales Td Ameritrade

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

.png)